Our Take: 2019 ACO Executive Survey – Preliminary Results

Jun 24, 2019

About two weeks ago, we began fielding our fifth annual ACO Executive Survey. With our editor being out on vacation this week, we thought it would be a good time to share some of the results so far. If you’re among those who completed the survey, thank you for your participation.

Readers who want more analysis and detail than is provided here should contact Darwin Research Group CEO and Our Take editor, John Marchica (jm@darwinresearch.com), about our ACOs and Value-Based Care syndicated research study.

1. Background

We have surveyed ACO executives annually since 2014. Our aim is to obtain unique insights into this growing market segment, with a focus on operational issues and partnering activity. Initially, our focus on partnering grew out of interest from some of our pharma clients, but it has since grown to include ACO relationships with other suppliers and providers.

During the first two weeks of June, we reached out several times to 1,795 ACO executives with an invitation to complete our online survey. Of the 1,582 deliverable email addresses, thus far we have received 78 completed responses (a 4.9% response rate). Respondents were entered into a drawing to win one of five $100 Visa gift cards.

The respondents include leaders participating in MSSP (76%), commercial (53%), Medicaid (14%), Next Generation (13%), and Advance Payment or Investment model (11%) ACOs. (Percentage totals do not sum to 100% as respondents were allowed to choose multiple ACO types.) A total of 5.33 million attributed lives are represented in this survey, with a median of 30,000 lives per ACO. The ACOs in our sample have been operational for a median of 58 months.

2. ACO priorities

We asked an open-ended question about the organization’s top priority for 2019, and, as expected, many participants provided multiple responses. Without question, ACO executives are most focused on reducing unnecessary use of resources. This includes reducing unwarranted emergency department use and hospital stays, and reducing unnecessary readmissions.

ACO executives are also focused on cost control, patient engagement/education, data management/analytics, and managing risk under new CMS rules.

“Negotiating the labyrinthine and ever-changing, ill-defined CMS rules,” one ACO executive wrote. “We represent independent primary care physicians, and our mission is to protect and support them. They (we) will soon be extinct.”

3. 2019 initiatives

We asked, “Do you have a particular focus, or special initiative, beyond routine care in the following areas for 2019?” Nearly all ACOs have or plan to have an initiative in diabetes (94%), as well as initiatives centered on behavioral health (85%) and cardiovascular issues (83%). Many respondents also said they either have or plan to have an initiative focused on obesity (56%) and Alzheimer’s disease/dementia (40%).

Providers and suppliers looking to team up with ACOs should be aware of these areas of focus and see if there are common areas of alignment.

4. Operational issues

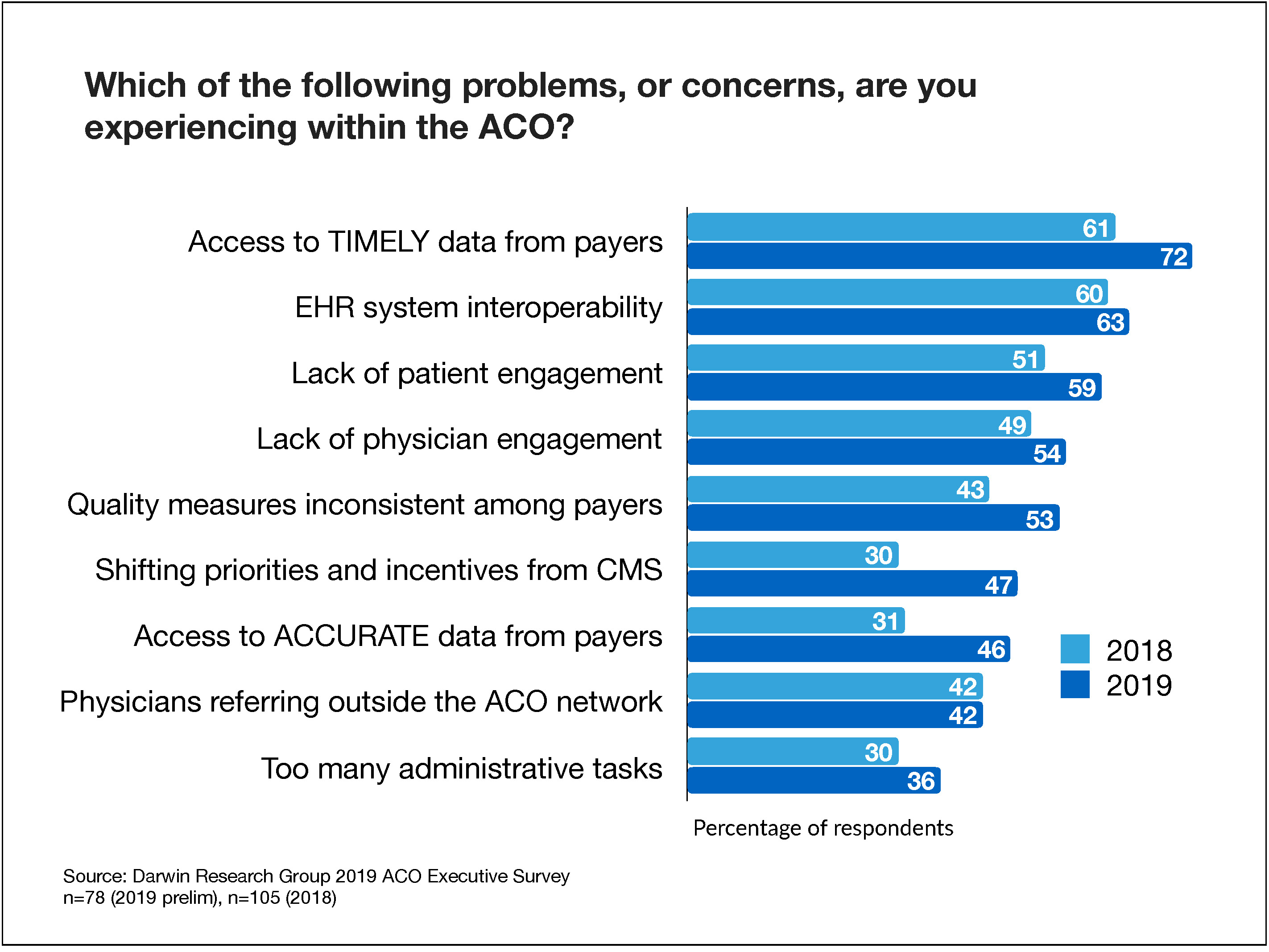

When asked which problems or concerns their organization is facing, ACO executives said lack of access to timely data from payers (72%) is their primary frustration; 61% of respondents noted this problem in 2018. Other substantial year-over-year increases in concerns include shifting priorities and incentives from CMS (47% versus 30% in 2018) and access to accurate data from payers (46% versus 31% in 2018).

Rounding out the top five problems mentioned in the survey responses are EHR system interoperability (60%), lack of patient engagement (60%), lack of physician engagement (56%), and inconsistent quality measures among payers (51%).

5. Factors affecting quality and cost

ACO leaders are beginning to notice that patients themselves can affect the quality of care. When asked to name which issue has the greatest effect on their ability to provide the highest quality of care, 27% said patient engagement in care/patient accountability. Of interest, one respondent suggested that because patients don’t view ACOs as an insurance plan, they may be less engaged than they are in a Medicare Advantage plan.

“Patients do not see themselves as part of an insurance plan within the MSSP program,” the respondent wrote. “Therefore, engagement is very different than with typical commercial or MA patients who understand that they enjoy the benefit of coverage at some price accompanied by some expectations of their behavior and choices, even if only to accept formulary and network policy.”

Other factors affecting the ability to provide high-quality care include access to timely data from Medicare or other payers (24%), physician engagement (17%), and EHR system interoperability (14%).

We asked a similar question about which issue has the greatest impact on the ACO’s ability to control costs. Two main cost drivers include keeping physician referrals within the network (29%) and having access to timely or accurate data from Medicare or other payers (27%).

Note that in contrast to the general question about problems and concerns, for these two questions respondents were forced to make a single choice.

6. Electronic health record interoperability

Although we’ve modified the survey slightly over the years to explore new topics, we’ve felt that this question is important since the nascent days of ACOs. Since 2014, we’ve asked the following question: “To what degree are the hospital and community-based physicians using the same electronic health record (EHR) system?”

Only 22% of the respondents said all or most physicians are on the same EHR — unchanged from a year ago. Even more surprising is that 41% said community physician and hospital EHRs are mostly on separate systems.

Technology is at the core of every ACO. We find it hard to accept that only a quarter of ACOs have everyone involved using the same system. It’s no surprise that 60% of ACO executives say EHR interoperability is a problem. We haven’t yet run the cross tabs, so it will be interesting to see how interoperability varies by ACO type, size, and years in operation.

7. Partnering activity

Specifically with respect to pharma, 14% of ACO executives said they’ve undergone a population health initiative with a pharmaceutical company using data from the ACO’s patient population. This number has been unchanged for the last three years.

In addition, 14% of ACOs have implemented an education, disease, or health management program with the financial support of a pharmaceutical company. This number has also consistently been at about 15% for several years.

We asked about the nature of their business relationships with eight types of suppliers and providers. The most common contractual relationships were with home health or home infusion providers (49%), skilled nursing or rehabilitation providers (47%), hospice providers (36%), and ambulatory care centers (36%). In addition, about a quarter of respondents said they were exploring a business relationship with each of these providers.

Of particular note, 82% of the ACO executives said they have no business relationship with a pharmaceutical company, compared with 77% in 2018.

Considering last week’s discussion of the Partnering with ACOs & IDNs Summit, this last point should awaken our pharma readers — at least those with responsibility adjacent to ACOs. Eight in 10 ACO executives don’t have a business relationship with pharma. There is an opportunity here, then, for pharma to close this gap and begin having, at the very least, conversations with ACOs.

Our pharma readers should also know that our survey revealed that 24% of ACOs have a Pharmacy and Therapeutics (P&T) Committee, with an additional 9% having an independent pharmacist or other oversight process to evaluate drug selection.

As we stated last week, pharma’s way forward is to clearly establish its value proposition and tie that value proposition to customer goals, with patients in mind. Put patients first, and the rest will follow.

We welcome your comments on our preliminary findings.

Subscriber feedback

Two weeks ago, we had our first reader comment, which was about our analysis of the market potential for Zolgensma, AveXis’ new gene therapy for spinal muscular atrophy. The reader wrote:

“The … calculations may make sense (economically) in a static world where the only options are this gene therapy or current treatments … but in a dynamic context where additional entrants might appear in the planning horizon, the future benefits should be discounted at a fairly high rate to represent the opportunity cost of forgoing those future treatments (which could be better, more effective, fewer side effects, cheaper).”

Another reader responded to that comment. His response, lightly edited for brevity, appears below:

“As a behavioral scientist, I’ve been securing feedback from clinicians on new and existing therapies for 40 years — including qualitative work with rheumatologists on the first injectable biologic for rheumatoid arthritis. The rheumatologists could not ‘get’ that the [then new] anti-TNF treatments had an entirely different mechanism of action from anything they had used, which ran the gamut from NSAIDs to injectable gold. Even when we showed them the late-stage clinical data, they asked for more support of a ‘durable effect.’ Maybe pharma has blown so much smoke over the years that docs no longer take what they’re selling at face value. Or maybe we all have a habit of looking at tomorrow’s therapies through yesterday’s lenses.

“The subscriber who is talking about the ‘other therapies’ that are alternatives to what AveXis has developed does not get genomic therapy. Spinraza is the only other real therapy out there besides palliative care. Zolgensma ‘fixes’ (permanently) how the body grows neurons into muscle to create a viable walking, talking, eating, drinking and, yes, peeing and pooping human being. It is head and shoulders above ‘more effective and fewer side effects.’ I am glossing over some details, but the clinical subjects went from ‘floppy babies’ (the common term used by clinicians for SMA type 1) to children who can run, bike and jump. I know there will be new issues of some sort, not unlike there are with immunotherapies, but this is an exception, because it is a mono-genomic fix.”

Steven Steiber, Ph.D.

Axxiom Healthcare Alliance

What we’re reading

Medicare Advantage is Booming. Why Are So Few Payers Winning? Boston Consulting Group, 5.23.19

Home Health Care Providers Struggle With State Laws And Medicare Rules As Demand Rises. Health Affairs, June 2019 (Open Access)

Academic Medical Centers: Too Large for Their Own Health? JAMA Viewpoint, 6.17.19