Our Take: New report shows hospital market concentration growing

Sep 23, 2019

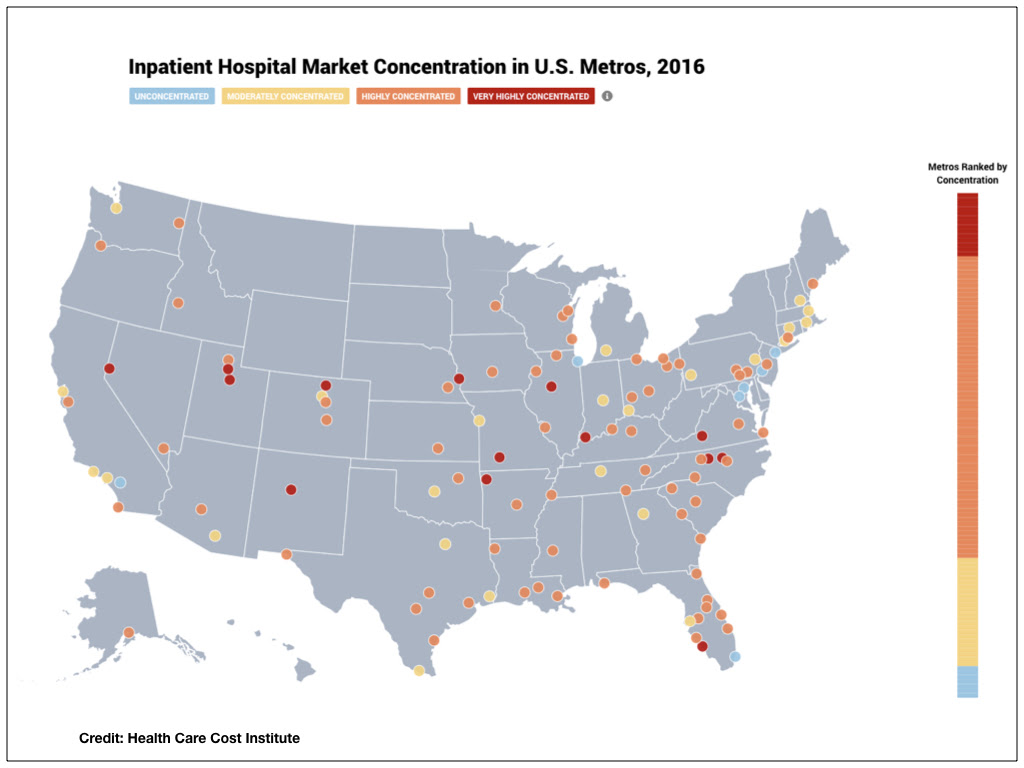

A new report from the Health Care Cost Institute (HCCI) shows that nearly three-quarters of U.S. hospital markets are highly concentrated. Further, 13% of markets are considered very highly concentrated. According to the researchers, highly concentrated hospital markets are associated with higher inpatient prices.

HCCI uses the Herfindahl-Hirshman Index (HHI) as its measure of market concentration; a higher value signifies a more highly concentrated market, where a smaller number of hospital systems account for a larger share of admissions. The HHI ranges from 0 (perfect competition) to 1 (a monopoly).

HCCI analyzed more than 1.8 billion commercial insurance claims from 2012 to 2016 in 112 metropolitan areas in 43 states. The work was funded by a grant from the Robert Wood Johnson Foundation.

Our Take: Let’s acknowledge the excellent ongoing work that HCCI does to inform policymakers and other researchers like us. The organization’s database includes 50 million commercially insured individuals per year (2008-2016) and as a “Qualified Entity” has 100% of Medicare fee-for-service claims on 40 million individuals per year. Now, let’s dig a little deeper into the findings.

First, with consolidation, markets are becoming more concentrated and less competitive. HCCI found that the number of highly concentrated markets rose from 67% in 2012 to 72% in 2016.

Second, these increases in concentration levels happened in more than two-thirds of the markets studied from 2012 to 2016, with a median increase in HHI of 0.0391. For instance, Milwaukee and Houston were moderately concentrated in 2012 but were highly concentrated by 2016.

Why this matters: As HCCI points out, “A merger that causes an increase in HHI of 0.0200 is sufficiently large enough to warrant further DOJ investigation within moderately concentrated markets and above per their guidelines.”

We typically associate consolidation through mergers as the driving factor for increased market concentration. But as the researchers wrote: “[A]n increase in market concentration can happen for a multitude of reasons, such as changes in patient preferences, quality improvements by certain providers, or changes in insurance networks, among other factors.”

These are the most concentrated markets, including the HHI (in 2016) and the dominant local system:

1. Springfield, Mo. (0.7795) — CoxHealth

2. Peoria, Ill. (0.7764) — OSF HealthCare

3. Cape Coral, Fla. (0.6930) — Lee Health

4. Greensboro, N.C. (0.6498) — Cone Health (Atrium)

5. Durham, N.C. (0.6437) — UNC Health Care

6. Albuquerque, N.M. (0.6394) — Presbyterian Healthcare Services

7. Ft. Collins, Colo. (0.5993) — UCHealth

8. Provo, Utah (0.5549) — Intermountain

9. Reno, Nev. (0.5372) — Renown Health

10. Omaha, Neb. (0.5289) — CHI Health (CommonSpirit)

Not surprisingly, some of our largest cities were the least concentrated (most competitive), including New York City (0.0759), Philadelphia (0.0964), and Chicago (0.1337). Also among the most competitive cities were Washington, D.C., Riverside, Calif., and Miami.

The researchers found a modest but statistically significant positive association between market concentration and price. For example, Salt Lake City had the sixth-largest increase in inpatient prices and the seventh-largest increase in market concentration.

Other cities, like Memphis, Tenn., showed no correlation between price and market concentration.

“Although consistent with previous literature, our analysis does not necessarily show that increases in concentration caused increases in prices,” the researchers wrote. “Changes in both measures could be due to many factors other than market consolidation which are related to both concentration and prices.”

What else you need to know

Novo Nordisk announced that Rybelsus (semaglutide), an oral glucagon-like peptide-1 (GLP-1) receptor agonist, has been approved by the Food and Drug Administration for the treatment of type 2 diabetes. The company said Rybelsus is the first and only GLP-1 analog available in pill form. The drug has been studied in 10 PIONEER clinical trials, which included 9,543 participants and featured head-to-head studies of Rybelsus versus Januvia (sitagliptin), Jardiance (empagliflozin), and Victoza (liraglutide). In the trials, Rybelsus reduced hemoglobin A1c and, as a secondary endpoint, showed reductions in body weight, the company said.

NUW Medicine, MultiCare Health System, and LifePoint Health have partnered to form a clinically integrated network known as Embright, the organizations announced in a news release. The network, based in Seattle, “will design and coordinate value-based care models to improve population health throughout the Pacific Northwest,” they said. Collectively, the three organizations represent 14 hospitals, more than 6,500 providers, and more than 600 outpatient sites of care. “We are exploring shared savings and shared risk models that are aligned with mutually agreed standards for the delivery of care, ” Dr. Christopher Kodama, president and CEO of Embright, said in the release.

Sanofi and Abbott are collaborating to integrate their diabetes-related technologies. By integrating glucose sensing and insulin delivery technologies, the two pharma giants hope to simplify how people with diabetes manage their disease. Sanofi is developing connected insulin pens — “smart” pens that have a memory feature and can be paired with apps and cloud software, which are also under development at Sanofi. The partnership will enable data sharing (with the user’s consent) between Sanofi’s technology and Abbott’s FreeStyle Libre mobile app and cloud software. The companies anticipate being able to offer the new products “within the next few years.”

Blue Shield of California is testing rideQ, a ride-share program launched by the Blue Cross Blue Shield Institute last year, in the Sacramento area. Initially, 1,000 Blue Shield members have been enrolled; they can book a ride with Lyft to and from pre-approved medical appointments at no extra charge. For now, eligible destinations include primary care providers and radiology and lab facilities affiliated with Hill Physicians in Elk Grove or Galt. RideQ is also being piloted in Pittsburgh, New Orleans, and Chicago.

Tennessee has proposed switching its Medicaid funding to a block grant. If CMS approves the plan, Tennessee could become the first state to move to a block grant system for Medicaid. The state would receive a fixed sum from the federal government — an estimated $7.9 billion — based on previous years’ Medicaid spending. Currently, there are no caps on federal funding for state Medicaid programs. Tennessee’s proposal includes a funding floor, or minimum amount the federal government would provide, as well as a per capita adjustment, should enrollment grow. Of note, any savings would be shared by the state and the federal government. The proposal also asks that Tennessee be exempted from any new federal mandates on eligibility or covered benefits during the course of the block grant. The public comment period ends on Oct. 18, and Tennessee must submit its Medicaid waiver application to CMS by Nov. 20.

Barriers such as access to timely data are slowing the shift to risk-based contracts, a recent survey of hospital and health system leaders shows. Medicare continues to be the primary catalyst for transitioning to risk-based payment arrangements — even though less than 20% of the respondents said that more than half of their population was covered by Medicare fee-for-service risk-based arrangements. Taking all payer types into account, most of the respondents said that less than 20% of their population was covered in a risk-based arrangement. Other barriers preventing the shift include inadequate reimbursement; lack of timely, accurate, standardized data; and matters such as changes in performance benchmarking and Stark law changes that need to be addressed through legislation. The survey was conducted by Premier in August.

What we’re reading

Primary Care Selection: A Building Block for Value-Based Health Care. JAMA Viewpoint, 9.12.19

Novel State Payment Models for Prescription Drugs: Early Implementation Successes and Challenges. Duke Margolis Center for Health Policy Report, 9.19

Hospital-Owned Physician Practices Raise Costs but Not Quality. Medscape, 9.12.19