Our Take: Supreme Court set to review $12 billion risk-corridor case

Jul 01, 2019

The Supreme Court has agreed to hear arguments from health insurers, who are claiming $12.3 billion in losses after the federal government reneged on payments owed to certain payers under provisions in the Affordable Care Act (ACA). Business leaders, including the U.S. Chamber of Commerce, had urged the court to review an appellate court ruling in June 2018 stating that the Department of Health and Human Services is not obligated to make risk corridor payments to insurers.

“This case is significant to the Chamber because many of its members do business and partner with the federal government in a variety of critical areas,” the Chamber of Commerce wrote in an amicus curiae brief filed in March. “These dealings are often conducted pursuant to federal statutes that include financial incentives, risk-sharing arrangements, liability limitations and other provisions that Congress implemented to induce the private sector to participate in the federal program. Such statutory commitments can only be effective, however, if the federal government honors its obligations to the business community and conducts itself as a reliable business partner.”

The Supreme Court will hear the case during its next term.

Our Take: Of the torrent of news we considered covering in this week’s Our Take, this story has the greatest potential national impact, touching upon business, health policy, and consumer health concerns. Long-term readers will recognize that we have written extensively about this issue. For those who are unfamiliar with the issue, here we provide a brief review.

The three-year risk-corridor program, which ended in 2016, was designed to encourage insurers to participate in the individual insurance exchanges by protecting them against extreme losses. Payers whose costs were below a set amount paid into the program, and those funds were then redistributed to insurers whose costs exceeded a set amount.

In a move led by Sen. Marco Rubio, R-Fla., Congress nixed the program in December 2014 with an appropriations bill that blocked any extra payments for the program beyond the “user fees” collected from profitable insurers, arguing that funding for the program wasn’t explicitly enumerated in the ACA. Three years of unpaid funds owed to insurers amounted to $12.3 billion.

(Ironically, the risk-corridor program was modeled after a similar scheme in the Medicare Part D drug benefit that was enacted when Republicans controlled both chambers of Congress and the White House.)

Insurers were promised this money through the ACA as a means to encourage participation on the exchanges. When Congress reneged on its promise, payers balked and headed for the exits. As competition declined with a reduced number of payers on the exchanges, premium price increases followed.

It’s the relation between supply and demand, as we learned in our first economics class: in a free market, as the number of sellers declines — if demand remains unchanged — prices will go up.

Critics of Obamacare at the time, concerned about skyrocketing premium prices, need look no further than to the actions of Marco Rubio and other lawmakers in December of 2014 — and that fateful appropriations bill that failed to fund the risk-corridor program.

Premium prices also increased for the payers who stayed on the exchanges as a means to recoup what the government had owed them. If the ACA’s risk-corridor program had been left intact, insurance premiums on the individual market likely would have increased just 10% between 2015 and 2017, according to an analysis by the non-partisan National Bureau of Economic Research (NBER). Instead, premiums increased 37% during that period.

Through extrapolation, NBER researchers estimated that ending the program accounted for 86% of all premium growth on the exchanges between 2015 and 2017.

We should emphasize that premiums have increased for employers as well, but not nearly at the rate of premiums on the exchanges. Using data from the Kaiser Family Foundation, we estimate that premiums for families increased, on average, 4.6% each year from 2008 to 2018. Individual premiums rose an average of 4.1% per year during the same period.

In any event, one might argue that premium increases were inevitable during that time because premiums were underpriced at the start of the ACA, which is why some payers — not all — lost money in certain markets. But it’s hard to argue that premium price increases would be as steep if there had been healthy competition among health insurance plans.

The reason this case matters goes to the point raised by the Chamber of Commerce. Businesses that engage with the government on programs like the ACA expect the federal government to be a reliable business partner. Payers got involved in Obamacare because they were assured that, at least for the first few years, the risk of pricing insurance in an uncertain market would be mitigated by a government operating in good faith.

If the federal government is allowed to renege on its promises — which so far has been the case — insurers and other businesses will hesitate to participate the next time they are asked to do so.

What else you need to know

AbbVie is set to buy Allergan for approximately $63 billion — the two companies announced Tuesday that they’ve entered into a definitive agreement. AbbVie’s offer includes 0.866 share of AbbVie common stock and $120.30 cash for each share of Allergan common stock, reflecting a 45% premium to Allergan’s closing price last Monday. The deal, which would make AbbVie the fourth-largest drugmaker in the world, is expected to close early next year. Allergan’s chairman and CEO, Brett Saunders, will serve on AbbVie’s board. Meanwhile, Pfizer, who offered to pay $160 billion to buy Allergan in 2015 but backed out because of tax rule changes, has agreed to acquire Array BioPharma for approximately $11.4 billion. According to a joint press statement, Pfizer will pay $48 per share in cash — a premium of about 62% based on Array’s closing price before the announcement. Array’s area of focus is cancer and “other diseases of high unmet need.” That transaction is expected to close later this year.

An executive order signed by President Donald Trump last Monday directs the Department of Health and Human Services (HHS) and other federal agencies to draft new rules and guidance that would increase the transparency of health care price and quality information. A goal is to enable consumers to make informed choices and compare prices for “shoppable” services — common services that can be researched ahead of time. Other directives in the executive order pertain to regulations for health savings accounts, direct primary care arrangements, and health care sharing ministries; greater access to claims data for research purposes; consolidating quality measures across all federal health care programs; and steps to address surprise billing. The new proposed rules could face pushback if industry stakeholders believe they’re too aggressive. As an example, Amgen, Eli Lilly, and Merck recently sued HHS and CMS to block the recent rule that requires drug manufacturers to disclose list prices in TV ads. That rule was supposed to take effect on July 9.

Sanford Health and UnityPoint Health have signed a letter of intent to explore a merger, the companies announced Friday. The combined system would have more than $11 billion in annual operating revenue, with operations in 26 states and nine countries, including hospitals, physician groups, clinics, health plans, clinical research, and other lines of business. While they’re still in the exploratory stages of the deal, the companies said the new company would be led by Kelby Krabbenhoft as president and CEO, and Kevin Vermeer as senior executive vice president. Krabbenhoft is currently Sanford’s president and CEO, and Vermeer is UnityPoint’s. While “timelines are still fluid,” leaders expect the deal to close by the end of 2019. The transaction is subject to customary regulatory reviews.

CityMD and Summit Medical Group (SMG) have agreed to merge. CityMD has more than 120 urgent care locations in New York, New Jersey, and Washington, D.C. Based in Berkeley Heights, N.J., SMG is an independent multispecialty medical practice with over 900 physicians at more than 80 locations throughout the U.S. Terms of the agreement were not provided in the organizations’ joint press announcement.

North Memorial Health and Blue Cross and Blue Shield of Minnesota (BCBSMN) will share ownership of North Memorial’s 20 primary care and specialty care clinics in a joint venture announced last Monday. Through its parent company, BCBSMN will acquire a 49% stake in the clinics, which are located throughout the Twin Cities. North Memorial’s president, Jennifer Close, will serve as CEO of the joint venture, which will begin operating in January 2020 as a separate business with an emphasis on value-based payments rather than volume of services. A goal is to reduce the cost of care by up to 20% in five years.

Southern California’s City of Hope will invest more than $1 billion to create a comprehensive cancer campus in Irvine, Calif., according to a recent press release. The organization is partnering with FivePoint Holdings to develop the campus, which will include an outpatient treatment center and a clinical research center (both expected to open by mid-2021) and Orange County’s only inpatient specialty hospital dedicated solely to treating and curing cancer (expected to open in 2025), Fierce Healthcare reported. Mayo Clinic also announced plans last week to invest $223 million in a new cancer treatment facility on its Jacksonville, Fla., campus that will include proton beam therapy. Mayo expects the facility to be completed in late 2023.

Executive moves

Dr. Jaewon Ryu is Geisinger’s new president and CEO, effective July 1; he has served in both roles on an interim basis since November. Prior to that, he was the Danville, Pa.-based health system’s executive vice president and chief medical officer. Earlier in his career, Dr. Ryu held leadership roles at Humana, the University of Illinois Hospital & Health Sciences System, Kaiser Permanente, and CMS. He was also a White House Fellow at the VA. More here.

Partners HealthCare has chosen Dr. Anne Klibanski as its new president and CEO. She was named interim president and CEO in February; previously, she was the health system’s chief academic officer. She was also chief of neuroendocrine at Massachusetts General Hospital. She is the Laurie Carrol Guthart Professor of Medicine at Harvard Medical School and an academic dean for Partners at Harvard. More here.

UnitedHealth Group (UHG) has named Dirk McMahon to lead UnitedHealthcare, its core health insurance business. McMahon is currently president and chief operating officer of UHG’s Optum unit. He replaces Steve Nelson, who is retiring from UnitedHealthcare, as CEO. More here.

Montefiore CEO Dr. Steven Safyer is retiring, Modern Healthcare reported Friday. Dr. Safyer has led Montefiore since 2008 and is known for pioneering the Bronx, N.Y.-based health system’s population health management program. He will remain in his role until a successor is named. More here.

What we’re reading

Fifth Circuit Questions Standing Of Parties Defending ACA In Texas v. Azar. Health Affairs, 6.28.19

Is Medicare Shared Savings Plan Working? Researchers at Odds. Medscape, 6.19.19

Pharmacy Benefit Manager Reform: Lessons From Ohio. JAMA Viewpoint, 6.20.19

By the numbers

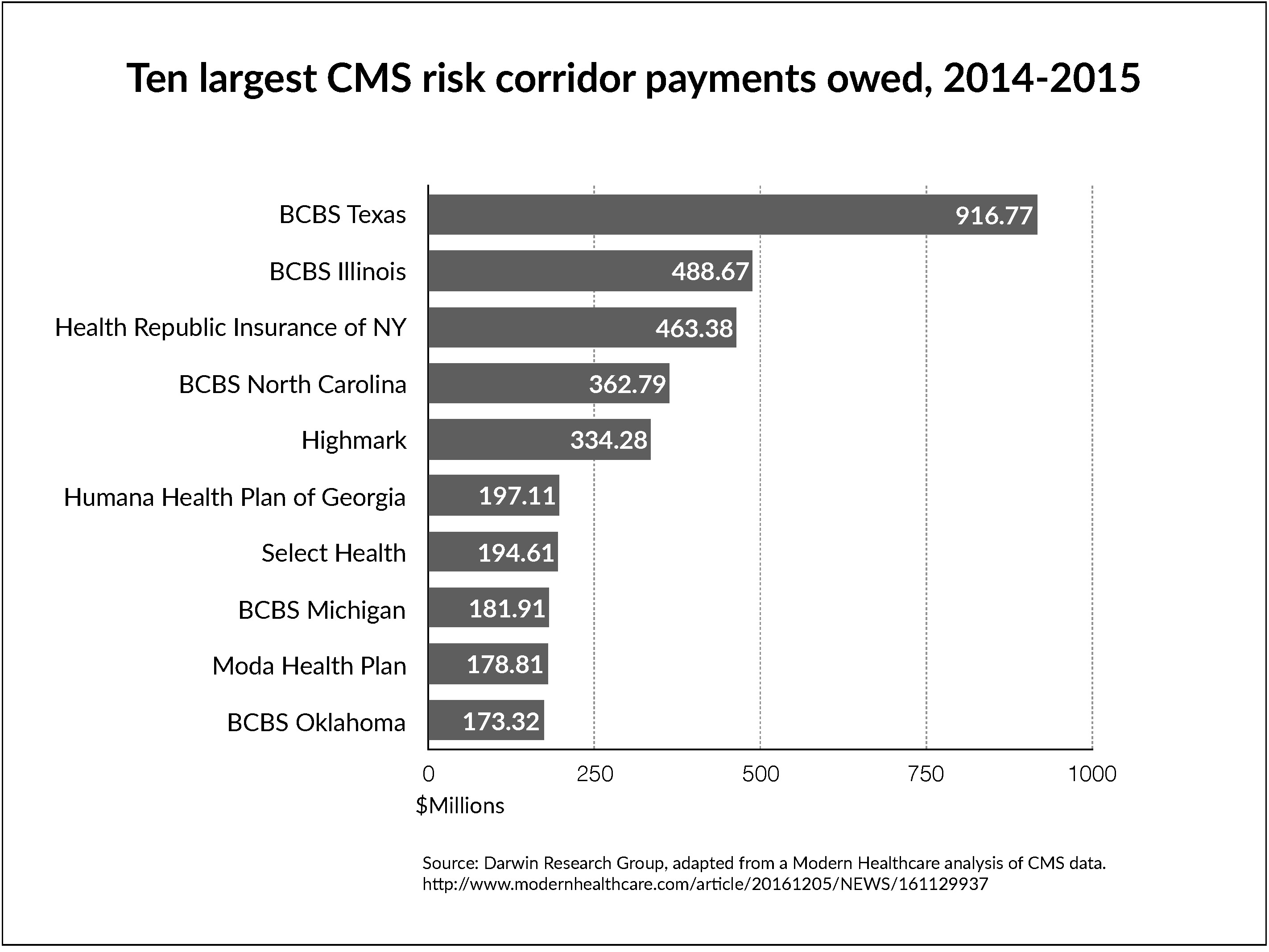

Using CMS data, in 2016 Modern Healthcare did an analysis of the money owed to insurance providers under the risk corridor program in the first two years. At the time, the federal government owed about $8.3 million in payments to insurers. The top 10 losers are shown in the chart below.

According to Health Affairs, among the biggest losers for 2016 were Humana of Georgia ($104 million); Blue Cross/Blue Shield Illinois ($116 million); Oscar of New York ($107 million); Blue Cross/Blue Shield of Texas ($168 million); and Select Health of Utah ($144 million).