Our Take: Walgreens, Microsoft partner to improve patient care

Jan 22, 2019

Walgreens Boots Alliance (WBA) and Microsoft announced a strategic partnership, with both companies committing to a multiyear research and development investment “to develop new health care delivery models, technology and retail innovations to advance and improve the future of health care.”

The companies also said they are exploring the potential to establish joint innovation centers in key markets, and in 2019 Walgreens will pilot a dozen store-in-store “digital health corners” to sell health care-related hardware and devices.

“Improving health outcomes while lowering the cost of care is a complex challenge that requires broad collaboration and strong partnership between the health care and tech industries,” said Satya Nadella, CEO of Microsoft. “Together with Walgreens Boots Alliance, we aim to deliver on this promise by putting people at the center of their health and wellness.”

Our Take: On its surface, this story seems much ado about nothing. Essentially, Walgreens has agreed to adopt Microsoft’s Azure cloud and AI platform, which probably stings Amazon, Google and other players in that market.

This is the second tech partnership that WBA has announced in a month. In December, Walgreens said it would collaborate with Verily, Alphabet Inc.’s life sciences unit, to develop solutions for patients with chronic conditions.

But this move is more than about adopting a platform. Walgreens expects to harness the power of all of its customer data to create a better consumer experience with the retail chain, and with health care delivery in general. The drug store giant aims to improve medication adherence, decrease hospital admissions and reduce emergency room visits.

Under the collaboration, Walgreens intends to create “more personalized health care experiences” by offering tools for preventive self-care and chronic disease management.

One of the partnership’s goals seems self-defeating, although in line with trends: to leverage its digital platform to provide telemedicine services for customers, allowing for virtual care “when, where and how they need it.”

Huh? We thought the primary reason for having in-store clinics was to drive traffic and increase retail sales.

“WBA will work with Microsoft to harness the information that exists between payers and health care providers to leverage, in the interest of patients and with their consent, our extraordinary network of accessible and convenient locations to deliver new innovations, greater value and better health outcomes in health care systems across the world,” said Stefano Pessina, Walgreen’s executive vice chairman and CEO.

In reference to Pessina’s remark, Walgreens will leverage Microsoft’s platform to create an ecosystem of consumers, providers, pharmaceutical manufacturers and payers.

“Major health care delivery network participation will provide the opportunity for people to seamlessly engage in WBA health care solutions and acute care providers, all within a single platform,” Pessina said.

Now that’s interesting. This is a partnership we will be following closely.

What else you need to know

UnitedHealth Group (UHG) reported strong revenue and earnings growth in 2018, according to a statement released Tuesday. UHG reported $226.2 billion in total revenue, compared with $201.2 billion in 2017, an increase of 12 percent. Earnings from operations grew 14 percent to $17.3 billion, compared with $15.2 billion in 2017. UHG said its Optum unit crossed the $100 billion mark for the first time, with $101.3 billion in revenue, an 11 percent increase over 2017, and $8.2 billion in earnings, a 22 percent increase compared with 2017.

“The 300,000 dedicated women and men of UnitedHealth Group are positively impacting society by restlessly pursuing a mission to help people live healthier lives and to improve health system performance,” said David Wichmann, CEO of UnitedHealth Group. “Their efforts led to accelerating growth across our enterprise in 2018 and created strong momentum for 2019.” More here.

Kaiser Permanente announced its first purchase of an affordable housing complex in East Oakland, Calif., marking the health system’s first effort at improving housing security and combatting homelessness. Kaiser said the move is part of its $200 million Thriving Communities Fund, a new joint equity fund between Kaiser Permanente and Enterprise Community Partners. Kaiser and Enterprise, in cooperation with the East Bay Asian Local Development Corp., will ensure that the property gets needed upgrades and is preserved as affordable housing. “Access to affordable housing is a key component to Kaiser Permanente’s mission to improve the health of our members and the communities we serve and to advance the economic, social and environmental conditions for health,” said Bernard Tyson, chairman and CEO of Kaiser Permanente. More here.

Average total drug spending per hospital admission increased 18.5 percent between fiscal years 2015 and 2017, according to a new study by NORC at the University of Chicago. Outpatient drug spending per adjusted admission increased 28.7 percent, while inpatient drug spending per admission increased 9.6 percent during the same period. Hospitals saw drug price increases in excess of 80 percent in certain classes of drugs, including those for anesthetics, parenteral solutions, opioid agonists and chemotherapy. Researchers also found substantial increases in drug shortages that have affected hospitals’ ability to manage drug spending. The study was commissioned by the American Hospital Association. More here.

Walmart will remain part of CVS Caremark’s network for commercial and managed Medicaid pharmacy customers, Reuters reported on Friday. Earlier in the week, Walmart said it was terminating its deal with CVS Caremark, putting commercial and managed Medicaid beneficiaries out of network. Walmart had reportedly sought increases in reimbursement rates, which CVS Caremark denied. Financial terms of the new contract were not disclosed. More here.

Humana has named Dr. William Shrank as its new chief medical officer, effective April 1. He is currently chief medical officer for the insurance services division at the University of Pittsburgh Medical Center (UPMC). Prior to his role at UPMC, Dr. Shrank was a senior vice president with CVS Health. He will succeed Dr. Roy Beveridge, who announced his retirement last year. More here.

What we’re reading

Apple should buy private digital health records operation Epic Systems, says Jim Cramer. CNBC 1.16.19

Scaling up to a telehealth future. NEJM Catalyst (no date, includes video)

Reducing the expert halo effect on pharmacy and therapeutics committees. JAMA Viewpoint 1.18.19

By the numbers

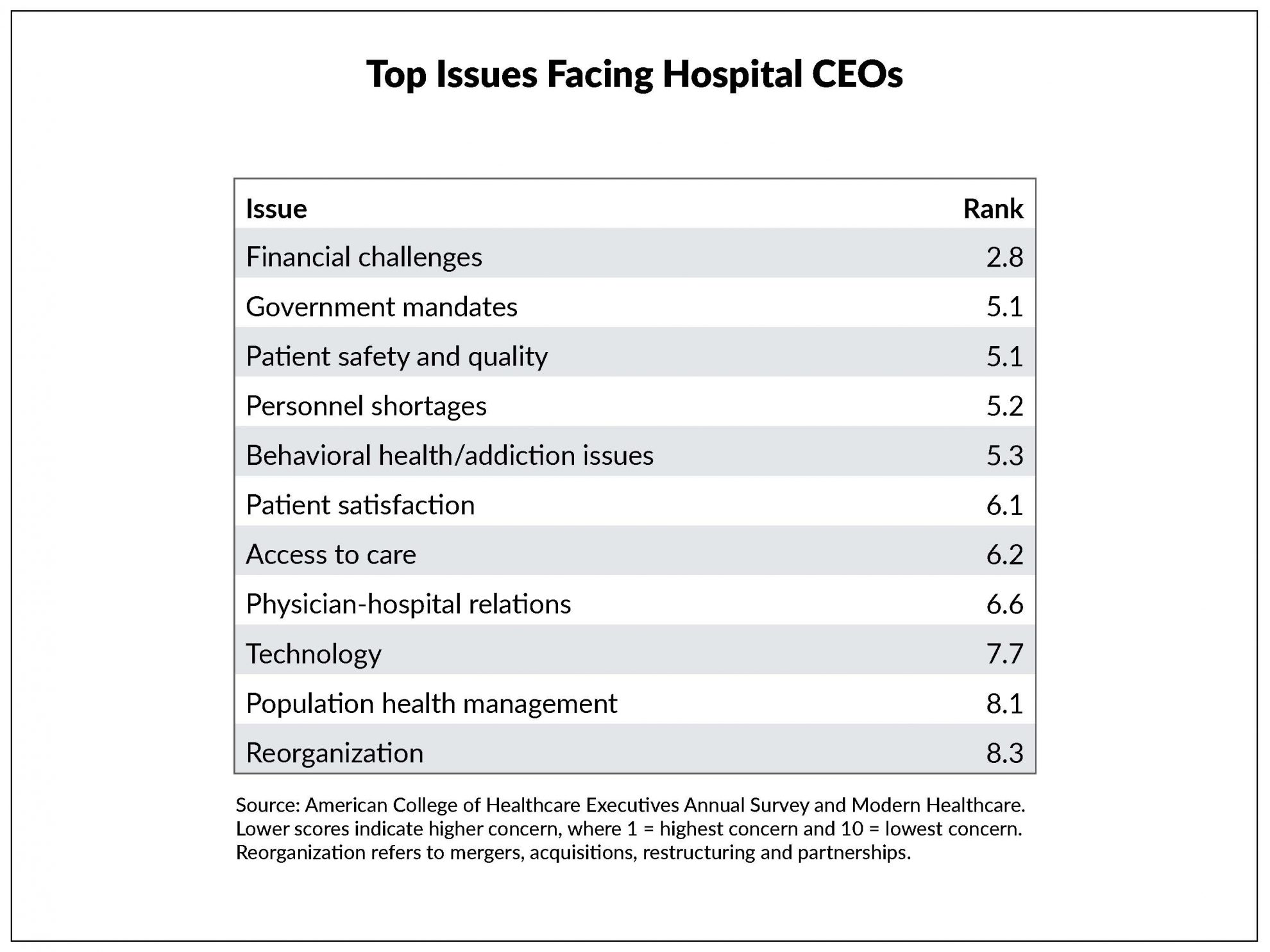

According to a new survey by the American College of Healthcare Executives (ACHE), financial challenges, government mandates, and patient safety and quality were the top concerns of hospital executives in 2018.

Top financial concerns included increasing costs for staff and supplies (70 percent), Medicaid reimbursement (68 percent) and reducing operating costs (56 percent).

In June 2018, ACHE mailed the survey to 1,402 member hospital CEOs; 355 members, or 25 percent, responded. Results were reported by Modern Healthcare here.

The score represents the average rank of each issue.